Code

# Packages List

packages <- c(

"tidyverse", # Includes readr, dplyr, ggplot2, etc.

'patchwork', # for visualization

'minpack.lm', # for damped exponential model

'nlstools' # for bootstrapping

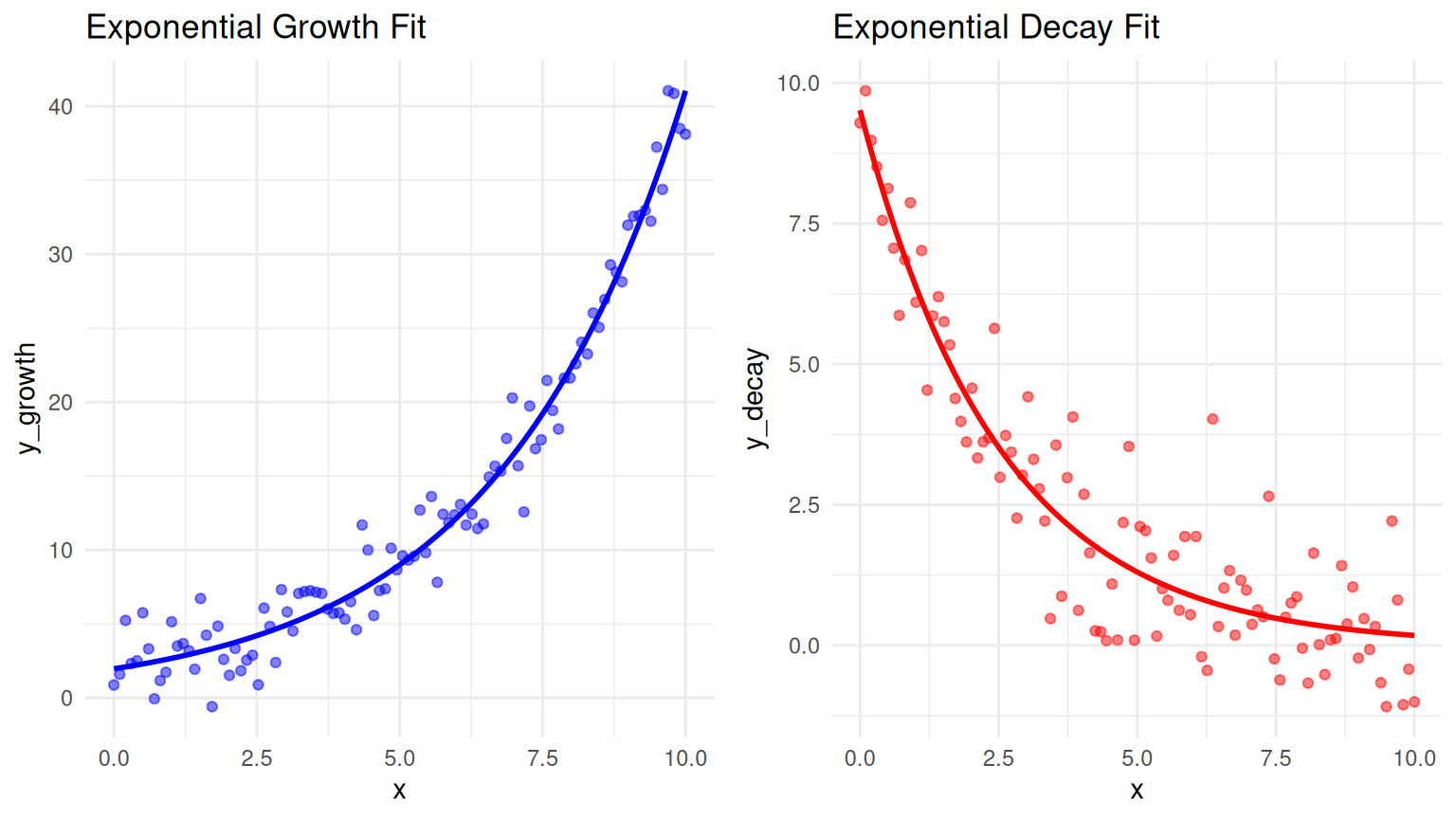

)Exponential models are a type of non-linear regression model that describes exponential growth or decay in a variable. Exponential models are widely used in various fields such as biology, finance, physics, and engineering to describe phenomena that exhibit exponential behavior. In this tutorial, we will explore exponential models, their applications, and how to fit exponential models in R.

Exponential Growth: Exponential growth models describe phenomena where a quantity increases at a rate proportional to its current value. Mathematically, exponential growth is represented by the equation \(y = a \cdot e^{bx}\), where \(a\) is the initial value and \(b\) is the growth rate.

Exponential Decay: Exponential decay models describe phenomena where a quantity decreases at a rate proportional to its current value. Mathematically, exponential decay is represented by the equation \(y = a \cdot e^{-bx}\), where \(a\) is the initial value and \(b\) is the decay rate.

Applications: Exponential models are used to describe a wide range of natural phenomena, such as population growth, radioactive decay, compound interest, and more.

Exponential models can be fitted using non-linear regression techniques such as the least squares method or the Gauss-Newton algorithm. These methods estimate the parameters of the exponential model by minimizing the sum of squared residuals between the observed and predicted values.

#| warning: false

#| error: false

# Install missing packages

new_packages <- packages[!(packages %in% installed.packages()[,"Package"])]

if(length(new_packages)) install.packages(new_packages)

# Verify installation

cat("Installed packages:\n")

print(sapply(packages, requireNamespace, quietly = TRUE))Successfully loaded packages: [1] "package:nlstools" "package:minpack.lm" "package:patchwork"

[4] "package:lubridate" "package:forcats" "package:stringr"

[7] "package:dplyr" "package:purrr" "package:readr"

[10] "package:tidyr" "package:tibble" "package:ggplot2"

[13] "package:tidyverse" "package:stats" "package:graphics"

[16] "package:grDevices" "package:utils" "package:datasets"

[19] "package:methods" "package:base" Exponential models are mathematical functions that describe exponential growth or decay. These models are used in various fields such as finance, biology, physics, and economics. Below are the different types of exponential models:

\[ y = a e^{bx} \] where: - \(y\) is the output, - \(a\)) is the initial value (when \(x = 0\)), - \(b\) is the growth rate (\(b > 0\)), - \(e\) is Euler’s number (\(\approx 2.718\)), - \(x\) is the independent variable (often time).

Exponential Decay Model

Formula:

\[ y = a e^{- bx} \]

where \(b > 0\), leading to a decreasing function.

Characteristics:

Below is an example of how to fit a Exponential Growth and Decay Models in R using nonlinear least squares:

You’ll need the nls() (nonlinear least squares) function for fitting nonlinear models and ggplot2 for visualization.

# Generate synthetic data

set.seed(123) # For reproducibility

x <- seq(0, 10, length.out = 100)

# Exponential Growth Data (y = a * exp(b * x))

y_growth <- 2 * exp(0.3 * x) + rnorm(100, 0, 2) # Adding noise

growth_data <- data.frame(x, y_growth)

# Exponential Decay Data (y = a * exp(-b * x))

y_decay <- 10 * exp(-0.4 * x) + rnorm(100, 0, 1) # Adding noise

decay_data <- data.frame(x, y_decay)

# ---- Fit Exponential Growth Model ----

growth_model <- nls(y_growth ~ a * exp(b * x), data = growth_data,

start = list(a = 1, b = 0.1))

growth_data$growth_pred <- predict(growth_model)

# ---- Fit Exponential Decay Model ----

decay_model <- nls(y_decay ~ a * exp(-b * x), data = decay_data,

start = list(a = 10, b = 0.2))

decay_data$decay_pred <- predict(decay_model)Warning: Using `size` aesthetic for lines was deprecated in ggplot2 3.4.0.

ℹ Please use `linewidth` instead.# ---- Plot Exponential Decay ----

p2 <- ggplot(decay_data, aes(x)) +

geom_point(aes(y = y_decay), color = "red", alpha = 0.5) + # Actual data points

geom_line(aes(y = decay_pred), color = "red", size = 1) + # Fitted curve

ggtitle("Exponential Decay Fit") +

theme_minimal()

# Display both plots

library(gridExtra)

Attaching package: 'gridExtra'The following object is masked from 'package:dplyr':

combine

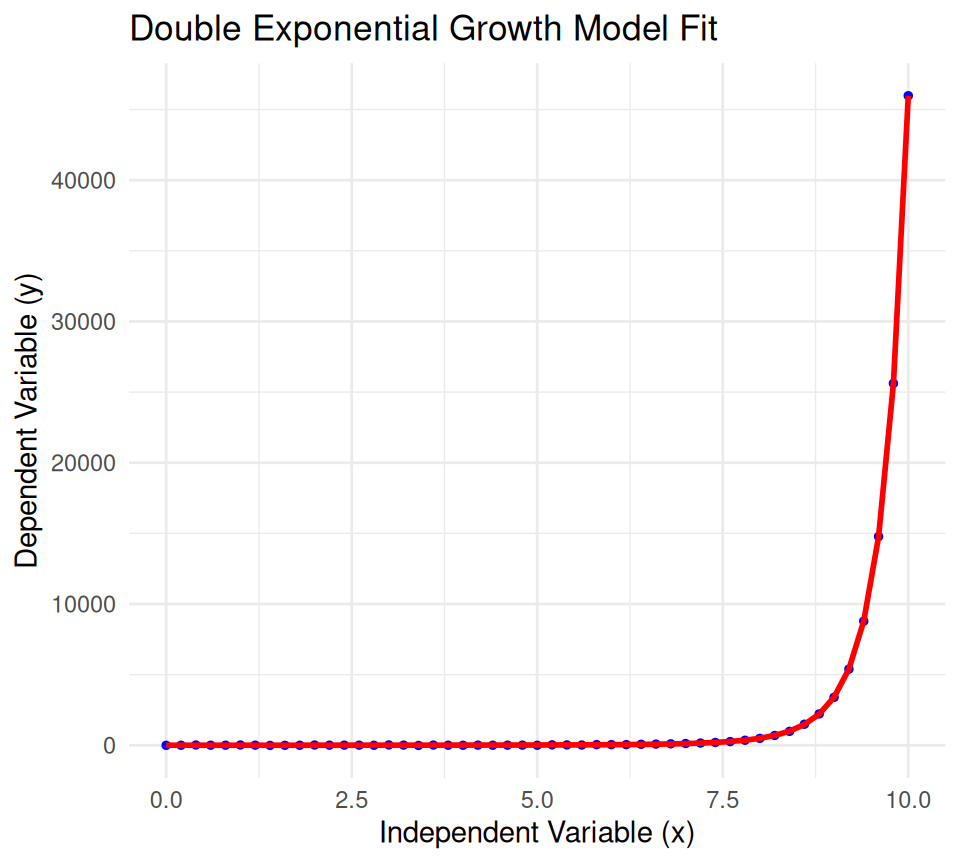

A double exponential growth model describes a process where the quantity grows at an accelerating rate, meaning the growth rate itself is growing exponentially. This model is characterized by a positive second growth rate. It is often used in contexts where growth accelerates over time, such as in certain financial markets, technological advancements, or biological phenomena.

The general form of a double exponential growth model is:

\[ y = a \cdot e^{b \cdot e^{cx}} \]

where: - \(y\) is the dependent variable. - \(x\) is the independent variable. - \(a\) is the initial value (the value of \(y\) when \(x = 0\)). - \(b\) and \(c\) are positive growth rates. - \(e\) is the base of the natural logarithm (approximately equal to 2.71828).

Below is an example of how to fit a double exponential growth model in R using nonlinear least squares:

# Generate example data

set.seed(123)

x <- seq(0, 10, by = 0.2)

a <- 2

b <- 0.5

c <- 0.3

y <- a * exp(b * exp(c * x)) + rnorm(length(x), sd = 10)

# Define the double exponential growth model function

double_exp_model <- function(params, x) {

a <- params[1]

b <- params[2]

c <- params[3]

a * exp(b * exp(c * x))

}

# Define the residual function for nonlinear least squares

residuals <- function(params, x, y) {

y - double_exp_model(params, x)

}

# Initial parameter guesses

init_params <- c(a = 1, b = 0.1, c = 0.1)

# Fit the model using nonlinear least squares

fit <- nls.lm(par = init_params, fn = residuals, x = x, y = y)Warning in nls.lm(par = init_params, fn = residuals, x = x, y = y): lmdif: info = -1. Number of iterations has reached `maxiter' == 50. a b c

2.0739010 0.4922369 0.3012036 # Generate fitted values

y_fitted <- double_exp_model(fitted_params, x)

# Plot the data and fitted model

plot_data <- data.frame(x = x, y = y, y_fitted = y_fitted)

ggplot(plot_data, aes(x = x)) +

geom_point(aes(y = y), color = 'blue', size = 1) +

geom_line(aes(y = y_fitted), color = 'red', size = 1) +

ggtitle('Double Exponential Growth Model Fit') +

xlab('Independent Variable (x)') +

ylab('Dependent Variable (y)') +

theme_minimal()

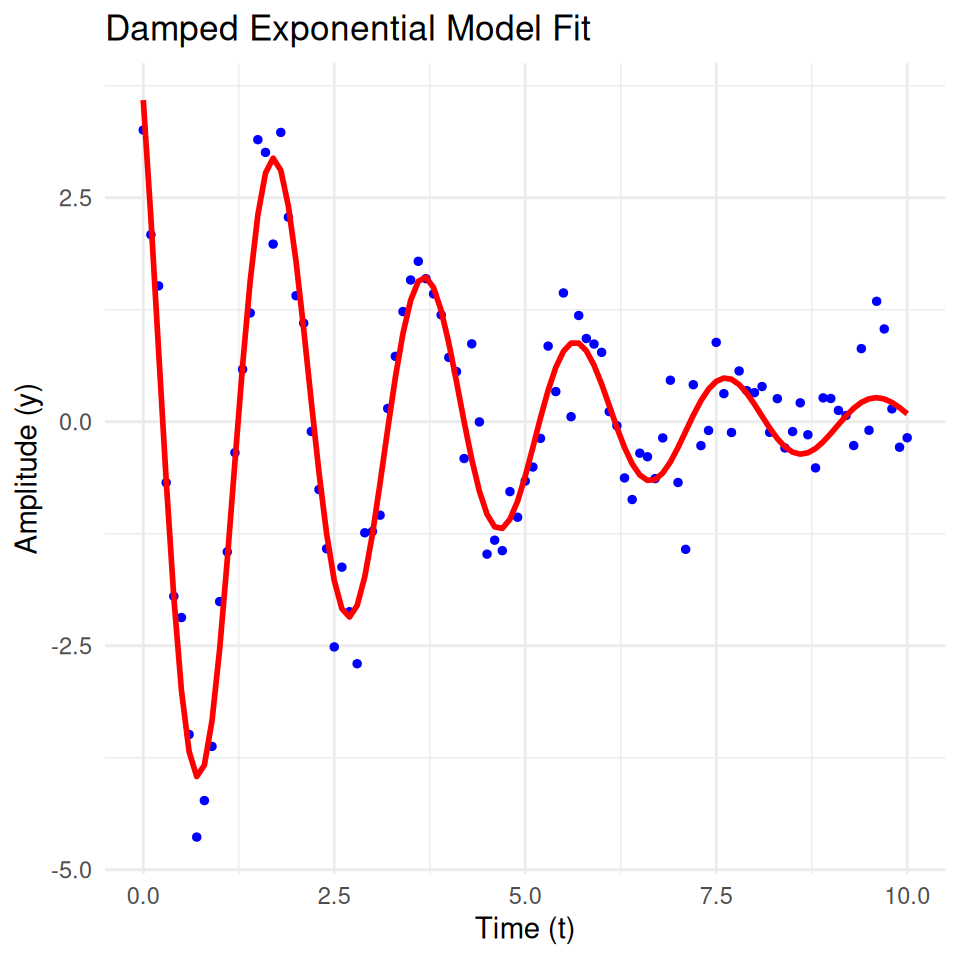

A damped exponential model describes a process where the amplitude of the oscillations decreases over time. This model is often used in physics and engineering to describe systems that exhibit damped harmonic motion, such as a mass-spring-damper system.

The general form of a damped exponential model is:

\[ y(t) = A \cdot e^{-\lambda t} \cdot \cos(\omega t + \phi) \]

where: - \(y(t)\) is the dependent variable at time \(t\). - \(A\) is the initial amplitude. - \(\lambda\) is the damping coefficient. - \(\omega\) is the angular frequency. - \(\phi\) is the phase shift. - \(e\) is the base of the natural logarithm (approximately equal to 2.71828).

Applications - Mechanical systems with damping (e.g., mass-spring-damper systems) - Electrical circuits with resistance (e.g., RLC circuits) - Biological systems (e.g., neuron firing patterns)

Below is an example of how to fit a damped exponential model in R using nonlinear least squares:

# Generate example data

set.seed(123)

t <- seq(0, 10, by = 0.1)

A <- 5

lambda <- 0.3

omega <- 2 * pi * 0.5

phi <- pi / 4

y <- A * exp(-lambda * t) * cos(omega * t + phi) + rnorm(length(t), sd = 0.5)

# Define the damped exponential model function

damped_exp_model <- function(params, t) {

A <- params[1]

lambda <- params[2]

omega <- params[3]

phi <- params[4]

A * exp(-lambda * t) * cos(omega * t + phi)

}

# Define the residual function for nonlinear least squares

residuals <- function(params, t, y) {

y - damped_exp_model(params, t)

}

# Initial parameter guesses

init_params <- c(A = 5, lambda = 0.3, omega = 2 * pi * 0.5, phi = pi / 4)

# Fit the model using nonlinear least squares

fit <- nls.lm(par = init_params, fn = residuals, t = t, y = y)

# Extract fitted parameters

fitted_params <- fit$par

print(fitted_params) A lambda omega phi

4.9541405 0.3033703 3.1848578 0.7603952 # Generate fitted values

y_fitted <- damped_exp_model(fitted_params, t)

# Plot the data and fitted model

plot_data <- data.frame(t = t, y = y, y_fitted = y_fitted)

ggplot(plot_data, aes(x = t)) +

geom_point(aes(y = y), color = 'blue', size = 1) +

geom_line(aes(y = y_fitted), color = 'red', size = 1) +

ggtitle('Damped Exponential Model Fit') +

xlab('Time (t)') +

ylab('Amplitude (y)') +

theme_minimal()

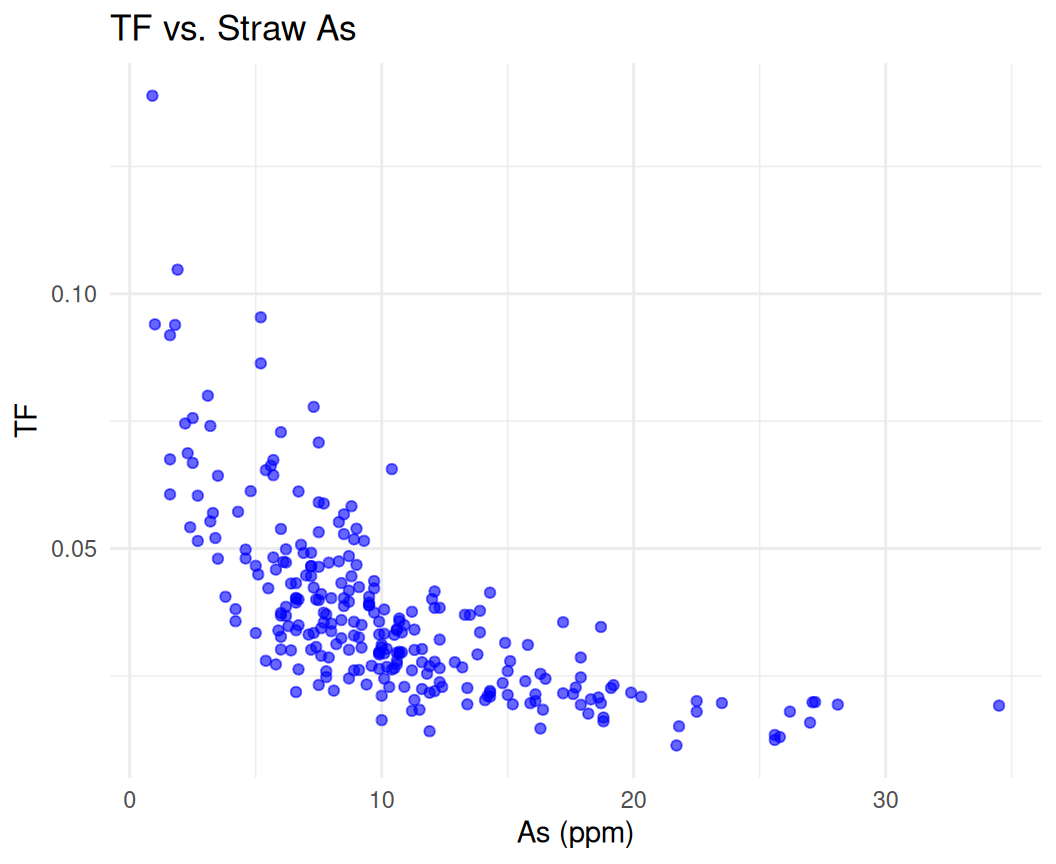

In this section, we will fit an exponential model to real-world data using R. We will use a dataset, which contains information about Arsenic (As) content in rice vaegeative parts (STAs) and Tansfer Factor (ratio of As in grain and straw). We will fit an exponential growth model to the relationship between STAs and TF to explore TF changes as As uptake increases by rice.

Rows: 260

Columns: 3

$ STAs <dbl> 0.9, 1.0, 1.6, 1.6, 1.6, 1.8, 1.9, 2.2, 2.3, 2.4, 2.5, 2.5, 2…

$ TF <dbl> 0.13888889, 0.09400000, 0.06750000, 0.09187500, 0.06062500, 0…

$ Rice_Var <chr> "Purbachi", "Purbachi", "Ratna", "Purbachi", "Purbachi", "Pur…

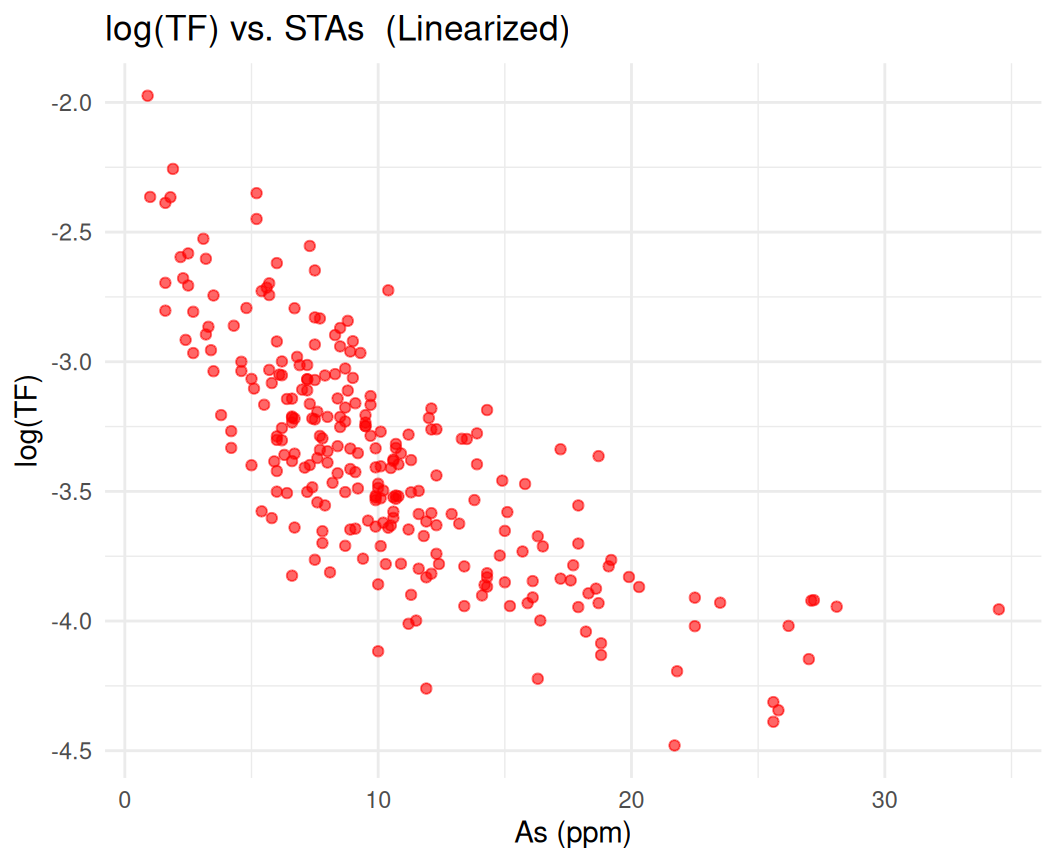

First we will performed Log-Transformation of the data to linearize the relationship for fitting:

# Add log(TF) column (avoid log(0) issues)

mf <- mf |>

mutate(logTF = log(TF)) # Already provided in your CSV, but we recalculate here

# Plot transformed data

ggplot(mf, aes(x = STAs, y = logTF)) +

geom_point(alpha = 0.6, color = "red") +

labs(title = "log(TF) vs. STAs (Linearized)", x = "As (ppm)", y = "log(TF)") +

theme_minimal()

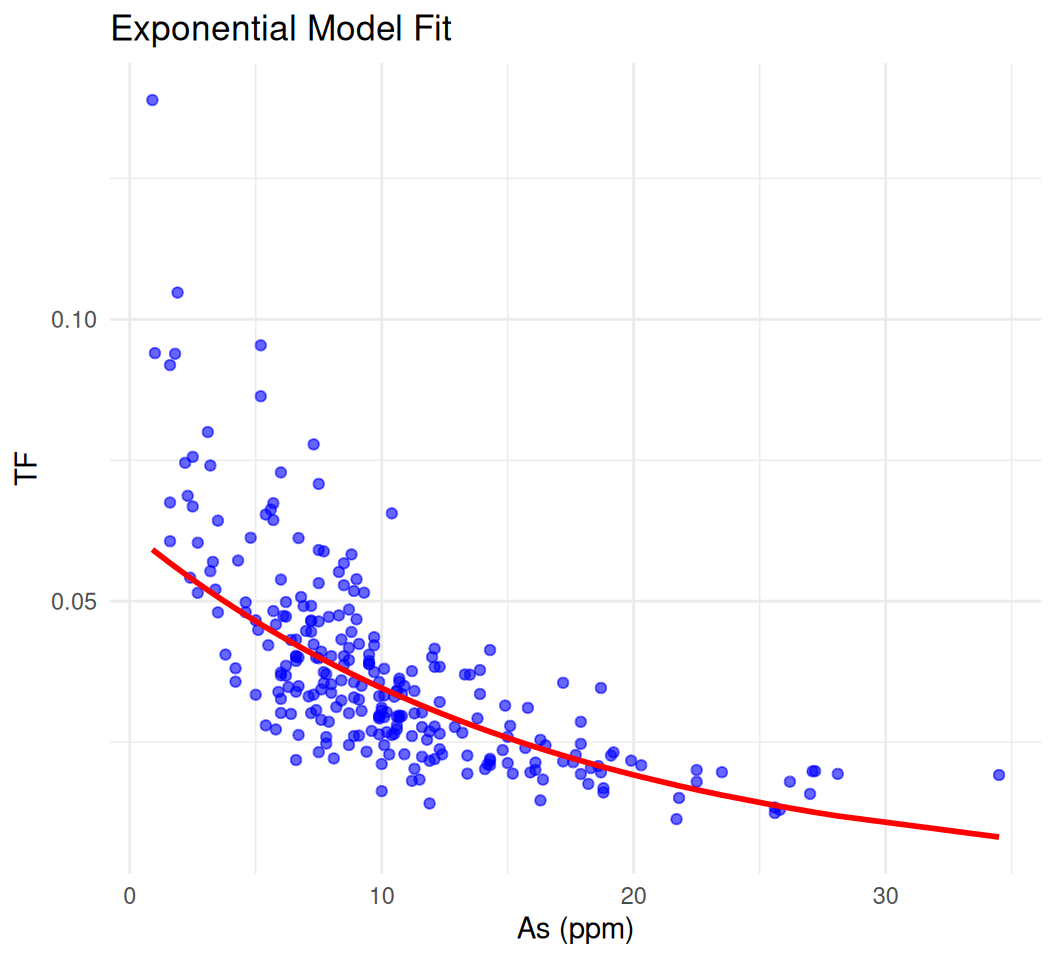

Now, we fit an exponential decay model to the log-transformed data using nonlinear least squares:

Call:

lm(formula = log(TF) ~ STAs, data = mf)

Residuals:

Min 1Q Median 3Q Max

-0.78385 -0.19435 -0.01188 0.18099 0.85474

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -2.774480 0.037201 -74.58 <2e-16 ***

STAs -0.058992 0.003173 -18.59 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.2835 on 258 degrees of freedom

Multiple R-squared: 0.5726, Adjusted R-squared: 0.5709

F-statistic: 345.6 on 1 and 258 DF, p-value: < 2.2e-16Inntercept (β₀): Estimated log(A) in the exponential model TF = A * e^(β₁ * stas).

Slope (β₁): Decay rate (since TF decreases as stas increases).

Use exp(coef(model)[1]) to recover A.

Exponential model: TF = 0.0624 * e^( -0.059 * STAs)# Add predictions to the data

mf$predicted <- exp(predict(model.exp))

# Plot raw data and fitted curve

ggplot(mf, aes(x = STAs, y = TF)) +

geom_point(alpha = 0.6, color = "blue") +

geom_line(aes(y = predicted), color = "red", linewidth = 1) +

labs(title = "Exponential Model Fit", x = "As (ppm)", y = "TF") +

theme_minimal()

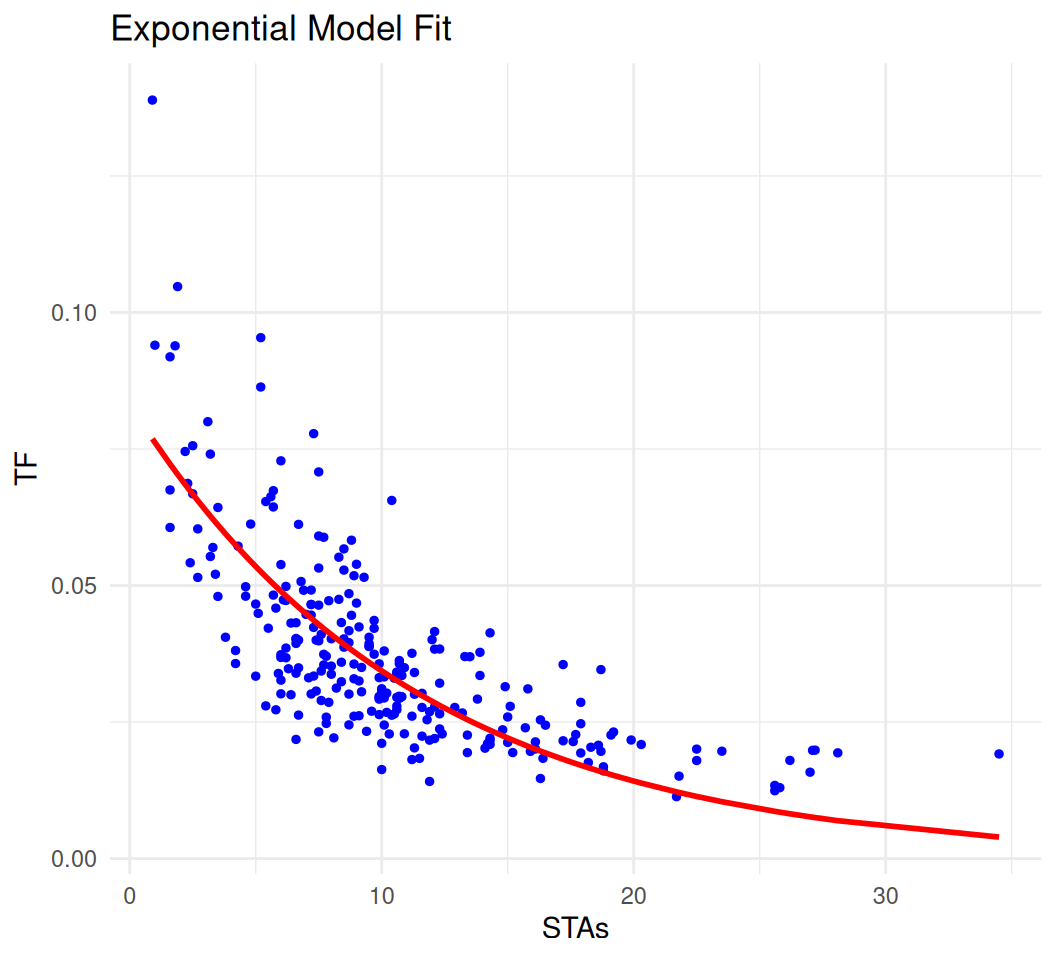

We can also use nls() function to fit an exponential model to the data:

# Define the exponential model function

exp_model <- function(params, x) {

a <- params[1]

b <- params[2]

a * exp(b * x)

}

# Define the residual function for nonlinear least squares

residuals <- function(params, x, y) {

y - exp_model(params, x)

}

# Initial parameter guesses

init_params <- c(a = 0.1, b = -0.1)

# Fit the model using nonlinear least squares

fit <- nls.lm(par = init_params, fn = residuals, x = mf$STAs, y = mf$TF)

# Extract fitted parameters

fitted_params <- fit$par

print(fitted_params) a b

0.08323492 -0.08845286 # Generate fitted values

y_fitted <- exp_model(fitted_params, mf$STAs)

# Plot the data and fitted model

plot_data <- data.frame(STAs = mf$STAs, TF = mf$TF, y_fitted = y_fitted)

ggplot(plot_data, aes(x = STAs)) +

geom_point(aes(y = TF), color = 'blue', size = 1) +

geom_line(aes(y = y_fitted), color = 'red', size = 1) +

ggtitle('Exponential Model Fit') +

xlab('STAs') +

ylab('TF') +

theme_minimal()

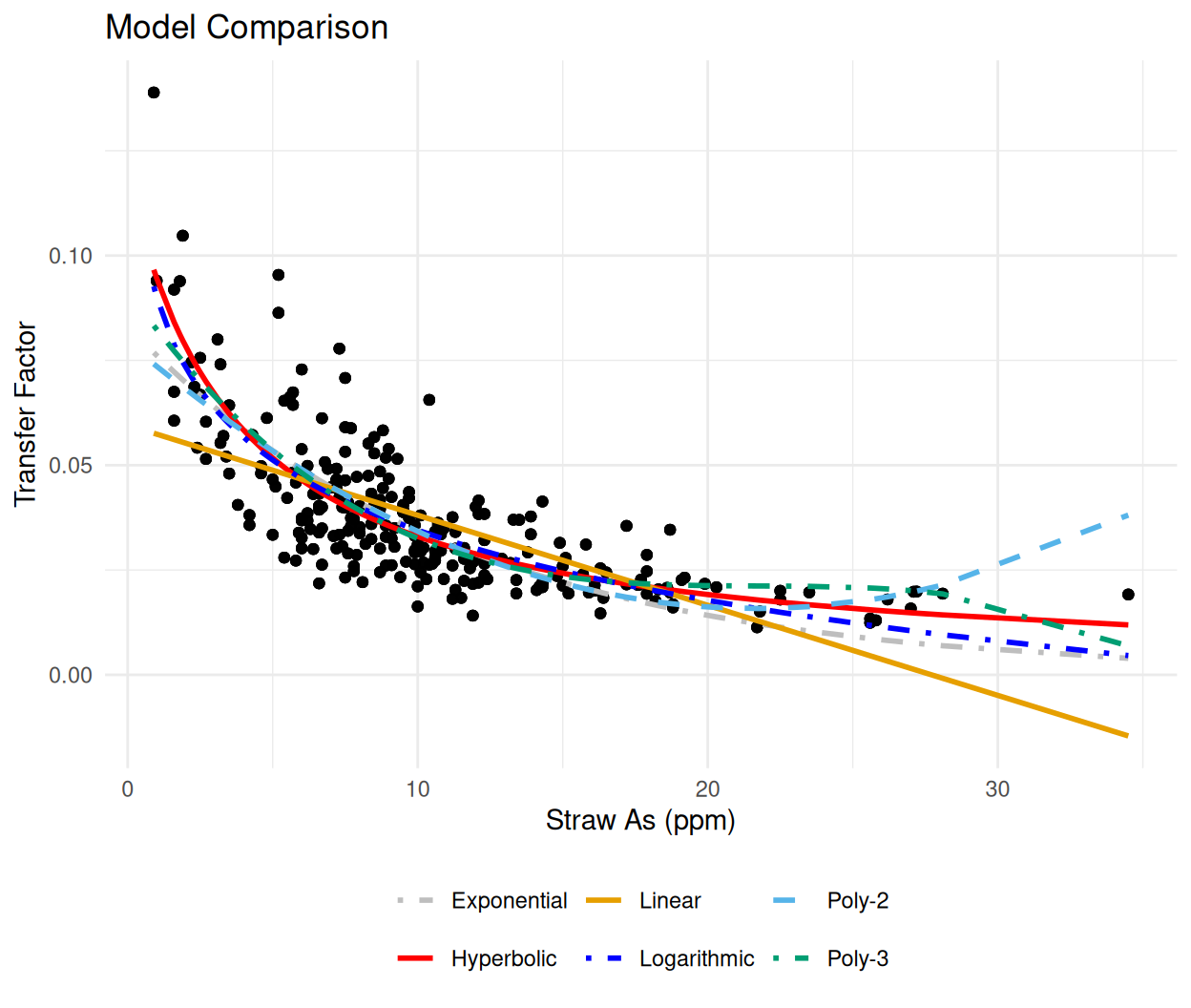

Now we can fit exponential model to the data and compare it with other models like linear, polynomial, logarithmic, and hyperbolic models to determine the best fitting model based on the R-squared value.

Call:

lm(formula = TF ~ STAs, data = mf)

Residuals:

Min 1Q Median 3Q Max

-0.023552 -0.008652 -0.002140 0.005127 0.081270

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.059553 0.001747 34.09 <2e-16 ***

STAs -0.002149 0.000149 -14.42 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.01331 on 258 degrees of freedom

Multiple R-squared: 0.4464, Adjusted R-squared: 0.4442

F-statistic: 208 on 1 and 258 DF, p-value: < 2.2e-16

Call:

lm(formula = TF ~ poly(STAs, 2), data = mf)

Residuals:

Min 1Q Median 3Q Max

-0.024706 -0.006661 -0.001025 0.004815 0.064736

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.0373524 0.0007182 52.010 <2e-16 ***

poly(STAs, 2)1 -0.1919900 0.0115802 -16.579 <2e-16 ***

poly(STAs, 2)2 0.1060970 0.0115802 9.162 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.01158 on 257 degrees of freedom

Multiple R-squared: 0.5827, Adjusted R-squared: 0.5794

F-statistic: 179.4 on 2 and 257 DF, p-value: < 2.2e-16

Call:

lm(formula = TF ~ poly(STAs, 3), data = mf)

Residuals:

Min 1Q Median 3Q Max

-0.023413 -0.006333 -0.001354 0.005036 0.055622

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.0373524 0.0006926 53.927 < 2e-16 ***

poly(STAs, 3)1 -0.1919900 0.0111686 -17.190 < 2e-16 ***

poly(STAs, 3)2 0.1060970 0.0111686 9.500 < 2e-16 ***

poly(STAs, 3)3 -0.0503123 0.0111686 -4.505 1.01e-05 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.01117 on 256 degrees of freedom

Multiple R-squared: 0.6133, Adjusted R-squared: 0.6088

F-statistic: 135.3 on 3 and 256 DF, p-value: < 2.2e-16

Formula: TF ~ a * exp(b * STAs)

Parameters:

Estimate Std. Error t value Pr(>|t|)

a 0.083235 0.003211 25.93 <2e-16 ***

b -0.088453 0.004960 -17.83 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.01158 on 258 degrees of freedom

Number of iterations to convergence: 6

Achieved convergence tolerance: 3.842e-06Logarithmic models are used when the rate of change in the data decreases over time or space. The general form of a logarithmic model is:

\[ y = a + b \cdot \ln(x) \]

where: - \(y\) is the dependent variable. - \(a\) and \(b\) are parameters that determine the shape of the curve. - \(\ln(x)\) is the natural logarithm of the independent variable \(x\).

Call:

lm(formula = TF ~ log(STAs), data = mf)

Residuals:

Min 1Q Median 3Q Max

-0.022725 -0.006195 -0.001335 0.004821 0.046222

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.090122 0.002608 34.55 <2e-16 ***

log(STAs) -0.024153 0.001153 -20.95 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.01089 on 258 degrees of freedom

Multiple R-squared: 0.6297, Adjusted R-squared: 0.6282

F-statistic: 438.7 on 1 and 258 DF, p-value: < 2.2e-16A hyperbolic model is a type of mathematical model used to describe relationships that follow a hyperbolic distribution. In its simplest form, a hyperbolic model can be represented as:

\[ y = \frac{a}{b + x} \]

where: - \(y\) is the dependent variable. - \(a\) and \(b\) are parameters that determine the shape of the curve. - \(x\) is the independent variable.

Formula: TF ~ a/(b + STAs)

Parameters:

Estimate Std. Error t value Pr(>|t|)

a 0.45618 0.02088 21.846 <2e-16 ***

b 3.82145 0.38951 9.811 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.01078 on 258 degrees of freedom

Number of iterations to convergence: 7

Achieved convergence tolerance: 8.432e-06metrics <- tibble(

Model = c("Linear", "Poly-2", "Poly-3", "Exponential", "Logarithmic", "Hyperbolic"),

RSE = c(summary(linear_model)$sigma,

summary(poly2_model)$sigma,

summary(poly3_model)$sigma,

summary(exp_model)$sigma,

summary(log_model)$sigma,

summary(hyperbolic_model)$sigma),

AIC = c(AIC(linear_model),

AIC(poly2_model),

AIC(poly3_model),

AIC(exp_model),

AIC(log_model),

AIC(hyperbolic_model)),

BIC = c(BIC(linear_model),

BIC(poly2_model),

BIC(poly3_model),

BIC(exp_model),

BIC(log_model),

BIC(hyperbolic_model)),

R2 = c(summary(linear_model)$r.squared,

summary(poly2_model)$r.squared,

summary(poly3_model)$r.squared,

1 - sum(resid(exp_model)^2) / sum((mf$TF - mean(mf$TF))^2), # Adjusted R-squared for nls

summary(log_model)$r.squared,

1- sum(resid(hyperbolic_model)^2) / sum((mf$TF - mean(mf$TF))^2)) # Adjusted R-squared for nls

)

metrics# A tibble: 6 × 5

Model RSE AIC BIC R2

<chr> <dbl> <dbl> <dbl> <dbl>

1 Linear 0.0133 -1504. -1493. 0.446

2 Poly-2 0.0116 -1576. -1561. 0.583

3 Poly-3 0.0112 -1593. -1576. 0.613

4 Exponential 0.0116 -1576. -1566. 0.581

5 Logarithmic 0.0109 -1609. -1598. 0.630

6 Hyperbolic 0.0108 -1614. -1603. 0.637# Add predictions

mf<- mf %>%

mutate(

linear_pred = predict(linear_model),

poly2_pred = predict(poly2_model),

poly3_pred = predict(poly3_model),

exp_pred = predict(exp_model),

log_pred = predict(log_model),

hyper_pred = predict(hyperbolic_model)

)

# Reshape predictions into long format for legend

mf_long <- mf %>%

pivot_longer(

cols = c("linear_pred", "poly2_pred", "poly3_pred", "exp_pred", "log_pred", "hyper_pred"),

names_to = "Model",

values_to = "Prediction"

) %>%

mutate(

Model = case_when(

Model == "linear_pred" ~ "Linear",

Model == "poly2_pred" ~ "Poly-2",

Model == "poly3_pred" ~ "Poly-3",

Model == "exp_pred" ~ "Exponential",

Model == "log_pred" ~ "Logarithmic",

Model == "hyper_pred" ~ "Hyperbolic"

)

)

# Define colors and linetypes

model_colors <- c(

"Linear" = "#E69F00",

"Poly-2" = "#56B4E9",

"Poly-3" = "#009E73",

"Exponential" = "gray",

"Logarithmic" = "blue",

"Hyperbolic" = "red"

)

model_linetypes <- c(

"Linear" = "solid",

"Poly-2" = "dashed",

"Poly-3" = "dotdash",

"Exponential" = "dotdash",

"Logarithmic" = "dotdash",

"Hyperbolic" = "solid"

)

ggplot(mf_long, aes(x = STAs, y = TF)) +

geom_point(alpha = 0.6, color = "black") +

geom_line(

aes(y = Prediction, color = Model, linetype = Model),

linewidth = 1

) +

scale_color_manual(values = model_colors) +

scale_linetype_manual(values = model_linetypes) +

labs(

title = "Model Comparison",

x = "Straw As (ppm)",

y = "Transfer Factor"

) +

theme_minimal() +

theme(

legend.position = "bottom",

legend.title = element_blank(), # Remove legend title

legend.spacing.x = unit(0.5, "cm") # Add spacing between legend items

) +

guides(

color = guide_legend(nrow = 2), # Split color legend into 2 lines

linetype = guide_legend(nrow = 2) # Split linetype legend into 2 lines

)

In this R tutorial, we explored various types of exponential models and demonstrated how to fit them using R. Exponential models are powerful tools for describing processes that exhibit growth or decay at rates proportional to their current values. Here is a summary of what we covered:

For each type of model, we discussed the mathematical equations and provided R code to generate example data, fit the models using nonlinear least squares, and visualize the results using ggplot2. By understanding and applying these models, you can accurately capture and predict the behavior of various real-world phenomena that exhibit exponential growth or decay.

By mastering these techniques, you can leverage exponential models to gain insights and make predictions in diverse applications, ranging from biology and physics to finance and engineering.

Here are some books and online resources that provide comprehensive information about exponential models, including their applications, fitting techniques, and theoretical foundations:

nls function in R is used for fitting nonlinear models, including exponential models. The R documentation provides detailed information on how to use this function.